Down Payment Assistance Programs: The Underused Solution to one of the Most Common Barriers of Homeownership

Coming up with a down payment is one of the biggest challenges that homebuyers, especially first-time buyers, face when it comes to buying a home. The amount that you need to be able to put down often depends on which loan program you’re qualified to use. Each loan program has different requirements and down payments can vary from 0% on a VA loan to 20% if you’re trying to avoid mortgage insurance on a Conventional loan.

Even as we have begun to see real earnings growth in the job market, it still takes a good amount of time to save up enough money for a down payment. In November 2023, it would have taken the average wage earner 1.7 years to save enough money for a 3.5% down payment. This number increases significantly for those hoping to be able to put down 20%.

One of the most widely available and underused solutions to the down payment barrier is down payment assistance.

What is Down Payment Assistance (DPA)

DPA programs are designed to make housing more affordable and accessible to homebuyers. These programs are created to bridge the gap for homeowners that are able to afford the monthly payments and other costs of owning a home but are struggling to come up with the upfront chunk of money needed to buy. DPA is offered by various organizations, including government agencies, non-profits, or sometimes private companies. The assistance can come in the form of a grant, a forgivable loan, or a low-interest loan.

How Does DPA Work?

DPA programs work by providing financial support to homebuyers to help you cover the upfront cost of buying a home. Each DPA is different, but there are general steps that they have in common:

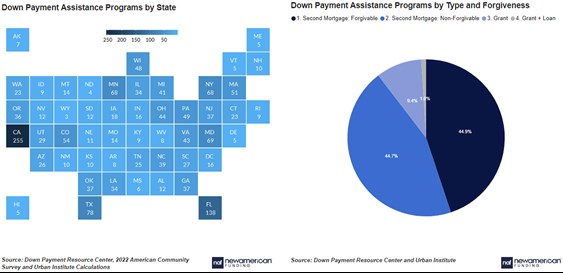

- Research: There are many different types of DPA that are available at different levels. California alone has over 250 different programs. These can be statewide programs or more localized by city or county. Each program has its own eligibility requirements, so don’t give up if you don’t find one you qualify for right away.

- Eligibility: There are different eligibility requirements for different programs. They may include income limits, credit score requirements, and property location restrictions. Keep track of your needs and your financial profile so you have an idea of which programs you may be able to qualify for.

- Apply: After you find one or more programs that may fit your needs, it’s time to apply for them. You’ll need to fill out the applicable paperwork. This will likely include submitting an application form and providing supporting documents. These can include proof of income, personal identifying information, credit information, and the location of the property you wish to purchase.

- Approval: Your application will be reviewed and the information you provide will need to be verified. If you meet the criteria, you’ll be approved and will receive funding that can be used toward your down payment and potentially your closing costs as well, depending on the program.

Types of DPA

Nationally, DPA programs tend to take two forms:

Second mortgage: Making up 89.6% of DPA programs, this is the most common form of down payment assistance. Of these loans, 81.9% are deferrable, where the borrower starts paying back the assistance several months or years into the mortgage.

In addition, 53.9% of these are forgivable. This means that there is a possibility of some or, in some cases, all of the loan being forgiven as long as you stay in the home for a certain period of time. These loans often have 0% interest.

Grants: Grants make up 9.4% of DPA programs. Grants are considered gifts and do not have to be repaid at all by the borrower. Make sure to double check the terms of your grant, though, so you don’t miss any important information.

DPA Requirements

Each DPA program has its own individual requirements. However, there are some commonalities:

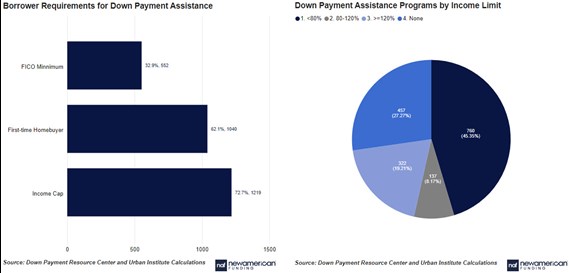

- 9% of programs have a minimum credit score requirement. The median credit score minimum for programs with the requirement is 640

- 1% of DPA programs have a first-time homebuyer requirement

- 7% of programs have income maximums; 45.3% have an income cap of 80% area medium income or less

- Since most programs are statewide or local programs, there are usually location restrictions

Finding DPA Programs

New American Funding offers an assistance program for first-time homebuyers called The Pathway to Homeownership. Specifically available to first-time homebuyers, eligible borrowers may receive up to $8,000* in financial assistance. This money can be used to help with your down payment, closing costs, or other costs depending on what you qualify for. It can also be combined with other DPA programs.

The U.S. Department of Housing and Urban Development (HUD) offers a state-by-state directory of resources, including DPA programs. HUD provides links to popular programs, focusing on those made available by government agencies like state housing departments.

Common Loans with Lower Down Payments

FHA loans: FHA loans are backed by the Federal Housing Administration and allow buyers to put down as little as 3.5%. They are primarily for borrowers with low to moderate incomes. FHA loans have fewer requirements than other lower down payment loans like VA and USDA loans, making them a helpful option for first-time homebuyers who may be restricted by their credit history.

While the usual credit score requirement to qualify for an FHA loan is 580, some lenders will allow for a minimum credit score of 500 with a higher down payment.

The requirements to qualify for an FHA loan are:

- A 3.5% down payment

- A 580 credit score (in most cases)

- A debt-to-income ratio of 45% (again in most cases)

- A two-year employment history to prove to lenders you'll be able to repay what you've borrowed

- The purchased home must be the primary residence and meet the basic livability standards

- The loan amount must be within the local FHA loan limits

USDA loans: USDA loans are governed by the U.S. Department of Agriculture and they have no down payment requirements that buyers will need to meet before qualifying, making this choice attractive to those looking to buy a house with no down payment as a first-time homebuyer. Eligibility is limited by location requirements and other factors.

Here are some requirements that will need to be met before qualifying for this choice:

- A credit score minimum of 580

- Proven creditworthiness

- A maintainable and dependable income

- A household income below 115% of the area’s median income

- The newly purchased home must be the primary residence in a rural area

- The applicant must be a legal and permanent resident of the United States

VA loans: VA home loans require no down payment to qualify. These loans are backed by the U.S. Department of Veterans Affairs and offer low rates and easy-to-meet requirements for borrowers with a certificate of eligibility (COE), allowing those who have invested their time with the military to buy a house with no down payment relatively hassle-free. They are available to eligible military servicemembers, veterans, and military families.

Like USDA loans, VA loans have requirements that must be met to qualify (simply qualifying for one of the below is enough):

- You must have served 90 or more days of active wartime service

- You must have served at least 180 days of active peacetime service

- You must have served six or more years in the National Guard or Reserves

- You are the spouse of a service member who has since died in the line of duty or due to a service-related disability

Each lender has their own unique set of loan terms and requirements for qualification, so make sure to check with your Loan Officer to find out what you can qualify for.

More Homebuyer Resources

Article Sources

NAF Insights

*Due to maximum seller concession rules, discount can be less than $8,000 in some cases where other concessions have been made to the consumer.