Homebuyers

Are You a First-Time Buyer? Surprise, It Doesn’t Always Mean Someone Purchasing Their First Property

October 9, 2025

If you’re considering buying a home, you’ve probably seen the term “first-time homebuyer” plastered across ads for various mortgages and down payment assistance programs.

But here’s the surprise: being a “first-time buyer” in the eyes of lenders and government programs doesn’t always mean it’s actually your first home purchase.

In fact, the federal definition is far broader. And those who qualify as first-time buyers may be able to secure lower down payments, lower credit score requirements, and grants or tax credits that can save you money on your home purchase.

“Most lenders and programs will look at your past homeownership to determine if you’re a first-time buyer,” said Martin Orefice, the CEO of Rent To Own Labs, based in Orlando, Fla. “If you owned a home in the past but have not had a primary residence in your name for at least the past few years, you [may] qualify as a first-time homebuyer.”

Here’s what you need to know about being a first-time buyer, what makes you eligible, and how to take advantage of the moniker.

Why the “first-time buyer” definition matters

Understanding how “first-time buyer” is defined can reveal benefits you may not realize you qualify for.

Generally, you’re considered a first-time buyer if you haven’t owned a principal residence in the past three years, according to the U.S. Department of Housing and Urban Development (HUD).

You may also qualify if:

- If you previously owned a mobile home, but it wasn’t permanently affixed to land.

- You only owned property with a former spouse.

- You only owned investment property but never used it as your principal residence.

This wider definition is key because it may make homebuying easier and more affordable.

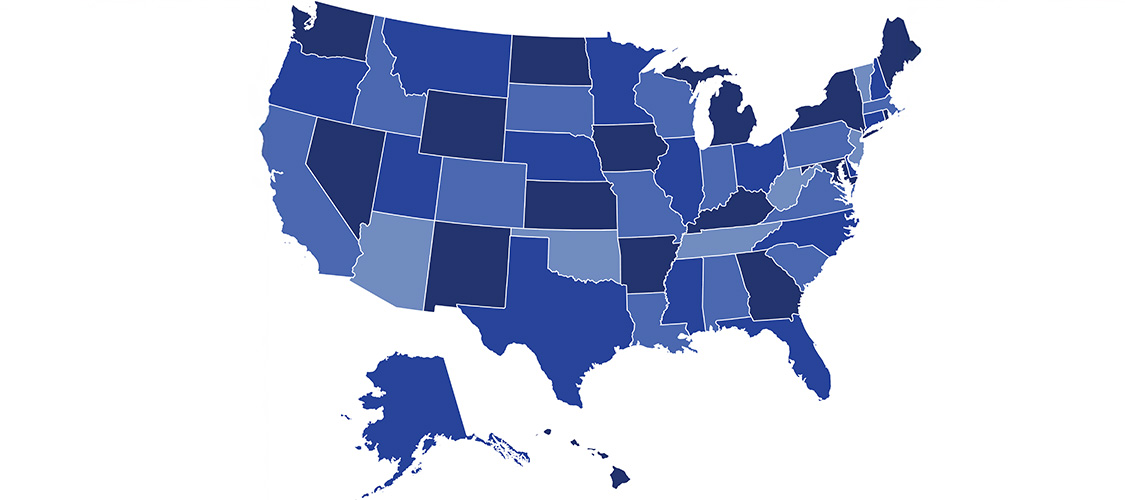

State and local down payment assistance programs

Nearly every state runs at least one down payment or closing-cost program exclusively for first-time buyers. These programs can provide homebuyers with additional funds that can provide them with a financial cushion.

The goal of these programs is to tackle the single biggest obstacle to homeownership: coming up with the cash for a down payment. Some provide a flat grant of say, $5,000 or $10,000 while funding lasts, while others offer low-interest “second” mortgages or forgivable loans layered on top of your primary mortgage.

Eligibility varies, but most share the same three pillars:

- You haven’t owned a principal residence in three years.

- Your income is at or below a state-set limit.

- You complete a homebuyer education course.

Popular state down payment assistance programs

In many markets, local housing agencies and nonprofits leverage state down payment programs with their own grants for specific neighborhoods or workforce groups. Because of the size of the states listed below, these are some of the largest programs.

- California’s CalHFA MyHome Assistance Program: Buyers can receive up to 3% of the home price in down payment or closing cost aid for first-time buyers who meet income and credit standards.

- Texas First-Time Homebuyer Program: Grants or deferred second liens are available to buyers through the Texas State Affordable Housing Corporation. These are only accessible to those who haven’t owned a home in the past three years.

- New York State of Opportunity First-Time Homebuyer Program: Buyers who complete a homeownership counseling course may be eligible to receive down payment and closing cost assistance for low- and moderate-income individuals.

“Assistance programs dictate the program’s intent to relieve financial barriers to entering the housing market,” said Olivier Wagner, a CPA and an IRS Enrolled Agent at 1040 Abroad. The company is based in London and New York City.

“The programs available and their offerings may vary, however, from state to state, so it is important that first-time homebuyers research what their state has available,” he said.

Mortgage credit certificates may be available for first-time homebuyers

Many state and local housing finance agencies also offer something called mortgage credit certificates, or MCCs. These are federal tax credits tied to your mortgage interest payments.

MCCs can reduce your annual tax bill by hundreds or even thousands of dollars. Crucially, most MCCs are reserved for first-time buyers as defined by HUD.

So, how does it work? The issuing agency certifies a percentage of your annual mortgage interest (often 20%–40%) as a direct federal tax credit, dollar for dollar.

The best part is you can still deduct the rest as usual. When combined with down payment assistance, an MCC can greatly improve affordability.

First-time homebuyer savings accounts

In 2025, 16 states, from Montana to Mississippi, have created first-time homebuyer savings accounts (FHSA) with tax advantages.

You (or family members) contribute money to a designated account, and the funds grow tax-free or tax-deductible up to certain limits.

When you’re ready to buy a home, you can withdraw the money for your down payment or closing costs, but only if you meet your state’s first-time buyer definition at the time of withdrawal.

Specialty first-time buyer programs

There are also specialty programs that require participants to be first-time buyers. Two standouts are:

- Good Neighbor Next Door (HUD): Aimed at teachers, firefighters, law enforcement officers, and emergency medical technicians (EMTs), this HUD program offers homes in areas that the local government is trying to revitalize 50% off the list price. In many cases, participants must certify they’re first-time homebuyers to qualify as well as make the properties their primary residences for at least three years.

- City or county grants: Many municipalities run one-time grants or low-interest loans exclusively for first-time buyers to stimulate homeownership in specific neighborhoods or to support workforce housing near major employers.

FHA loans

While Federal Housing Administration (FHA) loans themselves aren’t restricted to first-time buyers, they’re the backbone for many first-time assistance programs.

“FHA loans can allow you to purchase property with a lower down payment (sometimes as low as 3.5%), or more favorable credit score requirements,” said Wagner.

State and local housing agencies often structure their grants to align with FHA financing, requiring the buyer to meet specific first-time homebuyer criteria to qualify for the assistance. This “piggyback” approach means that FHA remains central to many first-time buyer options even if the mortgage itself isn’t limited to just these borrowers.

How to make the most of first-time homebuyer programs

Once you’ve figured out which programs you qualify for, some prep work can maximize your benefit. Here’s what to do:

- Check your ownership history. If you haven’t owned a principal residence in three years, you may meet the “first-time” test.

- Complete required education courses early. Many state programs won’t release funds without proof you’ve finished a HUD-approved homebuyer education course.

- Ask about stacking benefits. In some cases, you can combine a state grant, an MCC, and a city forgivable loan to cover much of your upfront costs of buying a home.

- Run the numbers with your lender. Down payment assistance can change your loan terms or payment structure. A good lender experienced with first-time buyer programs can help you maximize the mix.

- Get preapproved for a mortgage with your documentation ready. Having tax returns, pay stubs, and bank statements on hand keeps the process moving, especially important if grant funds are limited and first-come, first-served.

Smart Moves Start Here.

Smart Moves Start Here.