Homebuyers

Renting vs. Buying a Home: Which is Right for You?

September 8, 2023

The debate on whether it's better to rent or buy a home has been going on for decades and is likely to continue in the future as the real estate market evolves. Many renters would prefer to buy a home but believe that home prices have risen outside of what's reasonable for them to afford. However, the truth is that the medium- and long-term costs of buying a home can come out to be more affordable than renting.

Is renting cheaper than buying? What are the pros and cons of buying vs renting? Read on to compare the advantages of renting or owning a home.

What Are the Advantages of Buying a Home?

For many Americans, buying their first home is a symbol that they've “made it” and can live comfortably. But why is homeownership such an appealing dream for so many? Many of the advantages of being a homebuyer relate to building home equity as you make payments, which goes to build your net worth rather than your landlord's.

Equity building: Home equity refers to the portion of your home's value that you own minus any outstanding mortgage or loan balance. When you first buy a home, your equity will be equal to the percentage your down payment makes up compared to your loan value. Each time you make a mortgage payment, a portion of the payment goes toward your loan balance, increasing your equity.

By the time your loan is paid off, you will own your home in full. As you build equity, the home is also likely to increase in value over time as local real estate appreciates. You can also sell the home or turn it into rental property options that renters don't have.

Investment: Real estate has long been considered a viable long-term investment because real estate prices have historically risen over time. While the market might experience bearish and bullish periods influenced by factors like federal interest rates and real estate taxes, home prices have risen by an average of 4% per year for the past three decades. In addition to the money that you save in rent payments once you own your home in full, you're also likely to see a profit on your eventual home sale if you decide to move, assuming that historic market trends repeat themselves.

Tax benefits: When it comes to taxes, homeownership makes more financial sense than renting. You may be able to claim a tax deduction for private mortgage insurance (PMI) and interest from your federal taxes, reducing the amount of income you can be taxed on. You also may be able to deduct state and local taxes, while renters cannot deduct any portion of their monthly rent payment. Consult with a tax specialist to learn more about any tax benefits you may qualify for when buying a home.

Renting vs. buying a home comes down to your ability to invest. If you're in a stable place in both your life and career where you have the financial capacity to invest for the future, starting on the path to homeownership can be a great next step.

What Are the Things to Consider When Buying a Home?

While most of us dream of one day making the jump from renting to owning our space, the decision to buy a home shouldn't be taken lightly. Be sure to consider the following when deciding whether you're currently in the right place financially to buy a home.

Insurance expenses: Renters' insurance policies do not cover the physical structure of the home that you live in. Rather, they only offer protection for your things – the building you live in is covered under your landlord's insurance policy. Because of this, homeowners insurance is significantly more expensive per month than a renter's insurance policy for a similarly sized space.

Be sure to consider insurance costs when thinking about how much home you can afford. The larger and more expensive your home, the higher the premium you're likely to pay for homeowners insurance. Opting for a smaller home or downsizing before you move can help keep insurance costs low.

Not all expenses are tax deductible: While homeowners can take advantage of a few tax deduction options, not every property expense can be deducted. For example, most homeowners cannot deduct the monthly premium they pay to their mortgage lender from their taxes.

While you'll need to consider these limitations when you think about the costs and benefits of making the jump from renting to buying, know that there are exceptions to some rules. For example, business owners can deduct a portion of their monthly mortgage payment from their federal taxes if they maintain a home office. Consulting a tax professional can help you clarify which specific tax benefits are available to you.

Maintenance costs: When you rent a space and something breaks, you call your landlord to fix the problem. When you own a home, you'll need to cover the cost of these repairs on your own. Creating a household emergency fund can help create a safety net for your family if you run into expensive repair costs.

Estimating and anticipating these expenses ahead of time can help you enter the homeownership market at the right time and buy a home using a loan that fits your needs. Use our home affordability calculator to get an idea of how much house you might be able to afford.

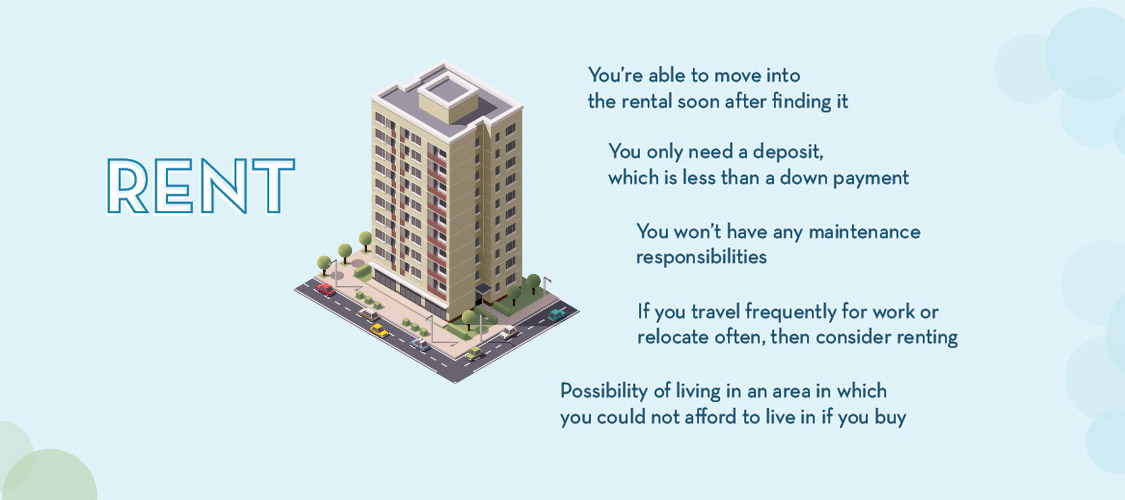

What Are the Advantages of Renting a Home?

While the home equity feature makes owning a home more appealing than renting in most cases, in a few circumstances renting a home can be the better choice. Some advantages of renting include the following.

Lower requirements: When you buy a home, you'll need to meet minimum credit and income requirements. However, these requirements are more lenient than most potential homebuyers believe – for example, you don't need a 700 credit score or a 20% down payment to qualify for most types of loans. If you're still working on establishing credit or tackling debt, you may want to hold off on buying a home for now.

Minimal surprise expenses: When you're a renter, home system and appliance problems are your landlord's responsibility. If your dishwasher suddenly stops working, you won't need to rely on your emergency fund to get it fixed. Renting while you save for a down payment or build a household emergency buffer can set you up to be in a great position to buy in the future.

More living flexibility: If you're early in your career and don't know where you want to settle down permanently, renting can be a stronger option. As a renter, you can choose not to renew your lease at any time, providing you with the ability to move as often as you need to, depending on the terms of your lease.

What Are the Things to Consider When Renting a Home?

While renting can be beneficial in some circumstances, you'll be missing out on the chance to invest in your future each time you make a rental payment instead of a mortgage payment. Be sure to consider the following before settling on renting over buying.

Missed equity: While owning a home and paying a mortgage loan helps you invest for the future, renting does not. Your landlord might even have a mortgage loan on the property you live in, meaning that you are paying rent, but they are getting the equity. The best reason to make the jump from renting to buying is to take advantage of accumulated home equity.

Limited personalization: Most landlords have limitations on how you can use and modify your space while you're renting. You will need to get landlord approval for changes, limiting your ability to make the property feel like your own. When you own a home, the only limitation on customization could be the local homeowners association – if there is one.

Rent increases: Landlords have the right to increase rent periodically, which can make it more difficult to anticipate your living expenses long-term. Regular rent increases can limit any money you might be saving by renting over buying. When you take out a fixed-rate mortgage, your mortgage payment doesn't increase.

Worried that you won't be able to pay for your loan if you lose your job in the future? Remember that refinancing to a longer term is an option after a few years of repayment and can lower your monthly rate while also helping you stay in your home.

Questions to Ask Yourself Before Choosing Between Buying a House vs. Renting an Apartment

When buying or renting a home, it's worth asking several important questions before making the final decision. Taking the time to consider these questions will help ensure that you make the right choice for your needs and lifestyle.

1. Am I ready to remain in my current area for years?

While you do have options to sell your home and move after getting a mortgage, it will take time to find a buyer. If you prefer more flexibility and freedom, you may prefer to rent. However, know that you will be missing out on investment opportunities in exchange for this flexibility.

2. Will I qualify for a home loan?

Mortgage lenders need to see that you're financially stable and responsible with credit before issuing a mortgage. Take a look at your current credit profile and determine if you are likely to qualify for a loan. An NAF Loan Officer can help. If you are not quite there, take some time to build credit before applying.

3. How do I want to design my space?

If you have unique design ideas and it is important to you to bring them to life, it can be better to buy your home. Landlords may limit your ability to change your space, which can lead to an unhappier living situation.

4. How long do you plan to live in your home?

The longer you stay in your home before selling it the better because your costs will be spread out over a longer period.

5. What are the housing costs in your area?

If renting is too expensive where you live, purchasing a home may be the better choice.

6. What are the current real estate market conditions in the area you're considering and why is it important?

Depending on the local housing market, it could be more financially prudent to purchase a home, or it could make more sense to rent. The state of the real estate market can affect how quickly properties are bought and sold, as well as what prices they go for.

7. What is the opportunity cost of paying taxes and insurance each month, plus your down payment?

Decide if this money is better instead invested in the stock market or a certificate of deposit (CD) account.

8. Do you have a stable income and employment situation?

If you have a stable income and employment situation, purchasing a house may be the better option for you. If you have a steady job with regular paychecks, then it will be easier for you to qualify for a loan and pay mortgage payments.

9. What is your budget?

Before you start looking at homes, make sure that you have a clear idea of what your budget is and how much you can spend.

10. How will current mortgage interest rates and rental rates impact your decision?

If the mortgage interest rate is low, then it could be more affordable for you to buy a home than it would be to rent an apartment.

11. Do you qualify for a home loan?

Before you start the homebuying process, you should contact an NAF Loan Officer to find out which home loans you qualify for.

12. What type of home do you want?

Are you looking for a single-family home, townhome, or condo? Consider the benefits and drawbacks of each option to make the best choice for you.

13. What type of lifestyle do you want?

Do you want to live in a vibrant city or a quiet suburb? Consider what type of lifestyle you want and what locations will best suit your needs.

14. Are you prepared for the additional costs of owning a home?

When you own a home, consider additional costs such as taxes, insurance, and maintenance. Make sure that you have enough saved up to cover these expenses.

15. How long does the homebuying process typically take?

The homebuying process typically takes a few weeks to several months, depending on many factors. It is important to assess your timeline when deciding between buying or renting a house.

16. Are you looking for a long-term investment?

You should stay in your home for at least a few years to make buying a home worth the investment.

17. Are you comfortable with the potential risks and fluctuations in property values?

Knowing the risks and how they can affect your financial position is essential when deciding between buying a house or renting an apartment.

18. What are your long-term goals and how does homeownership or renting align with them?

Homeownership can be a great way to build equity over time and provide stability and security. When you rent, you gain the flexibility of moving more quickly and efficiently than homeowners, but you aren't building equity for yourself in the process.

Is Renting Cheaper than Buying?

Some renters believe that it is a better financial decision to rent rather than buy because they believe they are saving money. However, this is not always the case. Each time your lease expires, your landlord can increase your rent – which can put a damper on the flexibility of month-to-month leases. On the other hand, fixed-rate mortgages provide predictability in monthly payments, making it easier to budget for housing costs over the life of the loan. If you value predictability in housing expenses, buying a home can be the better choice.

While the initial costs of buying a home can be higher because of down payments and closing costs, over the long term, homeownership often becomes more cost-effective than renting. Besides, help may be available from the federal and state governments. Ask your NAF Loan Officer about assistance programs you may qualify for.

When you make mortgage payments, you're building equity and working towards full ownership, unlike renting where your monthly payments don't accumulate ownership. If you run into a financial emergency later down the line, you can tap into your accumulated home equity.

Ultimately, the difference between renting a home and buying one is the difference between spending and investing. If you aren't sure if renting or buying is more affordable in your area, use our mortgage calculator linked above and a few local real estate websites to compare rental rates and mortgage premiums. You might be surprised at how similar the two figures are.

Consult a Loan Officer to Decide Whether to Rent or Buy

Ultimately, the decision to rent or buy a home depends on your financial details and life goals. Connect with a New American Funding Loan Officer today to start exploring your mortgage options – and find the right loan for your needs.

Renting Vs. Buying FAQs

Should I Rent or Buy a Home?

The decision to rent or buy a home depends on your circumstances and goals. Renting offers flexibility and the ability to easily relocate, but it does not build equity. Buying a home provides stability and the opportunity to build equity, but it comes with upfront costs and long-term financial commitments. Consider factors such as your financial situation, lifestyle, plans, and housing market conditions when making this decision.

What Factors Should I Consider When Deciding to Rent or Buy?

When deciding whether to rent or buy a property, consider factors such as the housing market, property prices, financial situation, affordability, lifestyle, plans, and market conditions. It is important to thoroughly evaluate these factors before making a decision.

Is Renting Cheaper Than Owning a Home?

Whether renting or owning a home is cheaper depends on location, market conditions, and individual circumstances. Renting eliminates costs like property taxes and maintenance, and provides more flexibility. Owning a home allows individuals to build equity and potentially benefit from property value appreciation, and provides stability and a sense of ownership. It is important to consider individual goals and costs before deciding.

Smart Moves Start Here.

Smart Moves Start Here.