Homebuyers

How to Read a Loan Estimate

January 13, 2022

The mortgage process can be confusing and overwhelming sometimes. We get it. Luckily, there are plenty of resources and tools available to make the process easier and less stressful for everyone who did not attend the University of Mortgage.

One of the most important resources available to you is a document called a "Loan Estimate." This document, which you will receive at the early stages of the mortgage process, is an invaluable tool that helps you understand the terms of your mortgage.

A Loan Estimate is a document prepared by a lender based on your personal information and tailored to your unique situation.

Want to know more? Let's dive into what a Loan Estimate is and how to read one.

What is a Loan Estimate?

In 2015, a federal government agency called the Consumer Financial Protection Bureau (CFPB) began requiring mortgage lenders to provide you with two new forms, the Loan Estimate and the Closing Disclosure. According to the CFPB, the Loan Estimate is provided by the lender in the mortgage process after you submit your application, while the Closing Disclosure must be received at least three business days before you are set to close on your loan.

These forms replaced older standard mortgage documents, which many people found to be confusing and cumbersome. These forms make it easier for you to compare the terms and conditions of their loan from the beginning of the loan process to the end.

The new forms offer a simplified view of a mortgage and its terms, aiming to make the mortgage process easier to grasp so you will fully understand your loan terms and costs before you sign on the dotted line.

The forms also make it easier for you to compare shop for a mortgage, a process that used to be much more difficult than it is now. Before the forms' introduction, it was not particularly easy to compare apples to apples when deciding between one mortgage offer or another.

The Loan Estimate form, which we will discuss in more detail below, solves that problem. It is a three-page document that provides you with all the important information about the mortgage loan, including the total loan amount, estimated monthly payment, estimated interest rate (or locked-in interest rate), and much more, all in one easy-to-read format.

Beyond being easy to read, the government mandates that all mortgage lenders use the same standardized Loan Estimate template. That means that no matter what lender you go to, your Loan Estimate form will look the same. The only difference between Loan Estimate forms from different lenders will be the terms, costs, etc. you receive from the lender.

So, what exactly is on a Loan Estimate form and how do you read it? Let's take a look.

What information is on a Loan Estimate form?

The Loan Estimate is a three-page document that lenders are required by law to issue within three business days of when you submit your application for a mortgage along with other important information.

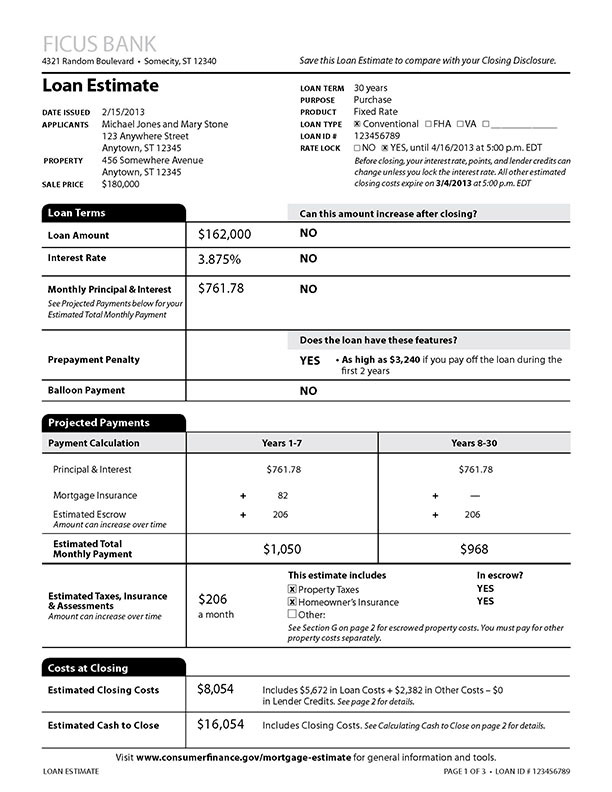

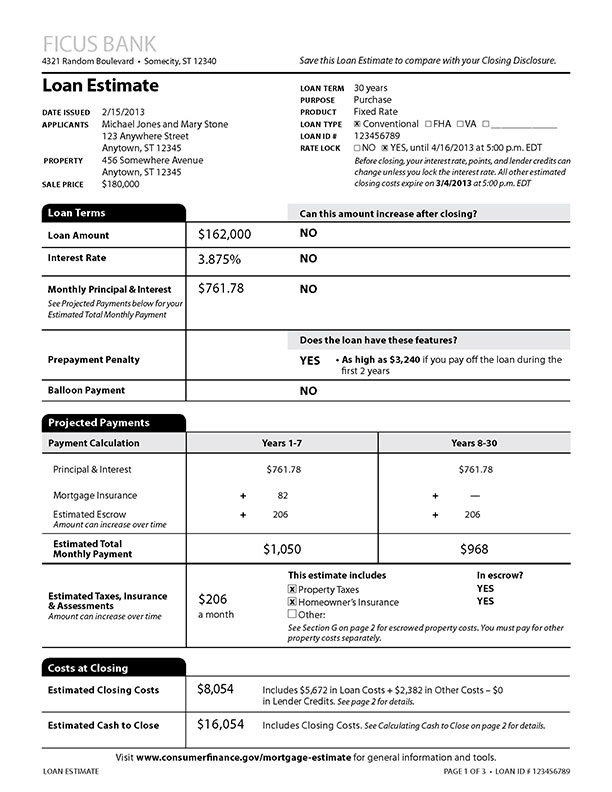

A Loan Estimate form has a lot of information on it, but the form is broken up into sections that help make the information easier to digest. Let's begin with Page 1.

Intro Section:

At the top left section of the form, you will see the date that the Loan Estimate was issued, the name of the mortgage applicant or applicants, the property address, and the sale price.

On the top right section of the form, you will find the loan term (or length of the loan), purpose of the loan (whether it is a purchase loan or a refinance), product type (whether the loan is a fixed-rate loan, an adjustable-rate loan, or another loan type), loan type (whether the loan is an FHA, VA, or a Conventional loan program), and whether your interest rate is locked or not.

Depending on market conditions, lenders may ask you if you want to "lock in" your interest rate at the current level or wait to see if conditions change. If the rate is locked, it will show on the Loan Estimate form.

Next up is the Loan Terms section.

Loan Terms:

This section is very important as it details the total loan amount for the mortgage you would be taking out, the interest rate you either could receive (if your rate is not locked) or the rate you will receive (if your rate is locked), and the monthly amount of principal and interest you will be paying. Note: This is not your monthly payment amount. That is located further down the form.

This section will also state in very clear "Yes" or "No" terms whether any of those amounts can change after your loan closes.

This section also includes information about whether your loan will have a prepayment penalty (some lenders will charge you a fee or penalty if you pay off your mortgage within a certain amount of time) or a balloon payment (in very rare cases, a loan may have a lump sum payment required at the end of the loan term).

Up next is the Projected Payments section.

Projected Payments:

In this section, you will see how much you will pay each month, broken down by principal and interest, mortgage insurance (if you will be required to pay mortgage insurance), and an estimated monthly escrow amount if you are escrowing your property taxes, homeowners insurance, or other items.

These items combined will make your estimated monthly mortgage payment.

After this section is the Cost at Closing section.

Cost at Closing:

The section lays out how much your estimated closing costs will be and how much cash you will be required to pay to close on the loan. However, depending on your loan, you may not be required to provide money when your loan closes. This section does not break down how these costs are calculated (that appears on the next page of the form), it simply shows the total amount of each of those costs.

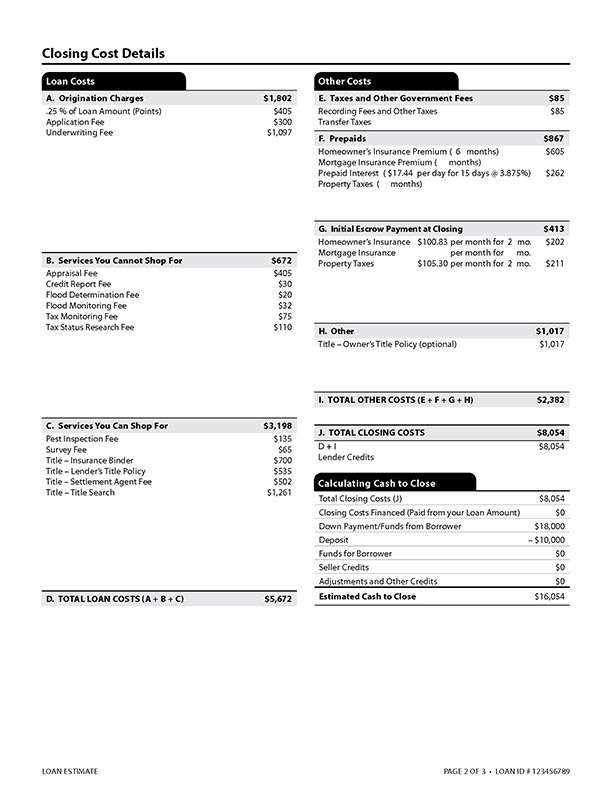

Now, let's move on to Page 2, which provides details on the closing costs.

Loan Costs:

In section A of this segment, which appears in the top left section, details your origination charges, which are the fees you will be paying to the lender for originating your mortgage. These fees may include the application fee, underwriting fee, and whether you are paying any points on the loan.

Points are fees you can pay to lower your interest rate. One discount point is equal to 1% of your total loan amount.

Below that there are two important sections, especially if you are interested in shopping around. These are various fees for services that go towards the origination of your mortgage. These are broken down into two categories: "Services You Cannot Shop For" and "Services You Can Shop For."

One note before we dive into these sections, it's possible that not all of these fees will appear on your Loan Estimate. Let's just consider these to be examples of what may appear.

The first section is Services You Cannot Shop For. These included the Appraisal Fee (the fee paid to an appraiser to value the house you're interested in buying or refinancing), Credit Report Fee (a fee for pulling your credit report), a Flood Determination Fee, Flood Monitoring Fee, Tax Monitoring Fee, Tax Status Research Fee, and mortgage insurance (if required by the loan program).

These fees are all part of the lender's origination process and you are not permitted to shop around for these services. That's because these fees are charged by the company the lender is using to provide these services, like the appraiser or the credit reporting agency.

The next section, on the other hand, contains services you can shop for.

This section includes a Pest Inspection Fee, Survey Fee, settlement agent fees, and various title insurance fees. You can shop around for these services. If you choose to do so, use your Loan Estimate as a guide and compare the prices you can find to the ones provided by the lender.

These costs are added together and presented at the bottom of the left side of the page as the "Total Loan Costs."

On the other side of the page is the Other Costs section.

Other Costs:

This section provides details about various other costs that are part of your closing costs. Included in this section is information about taxes and government fees, any prepaid interest based on your closing date, and any initial deposit that will be made to establish your escrow account.

Below this section, you will find a total of these "other costs". Below that, you will see the total closing costs, a figure reached by combining the total loan costs and the total other costs. In this section, you may also see a dollar amount listed in the Lender Credits section. Lender credits may be a rebate provided to you by the lender to offset some of your closing costs, but you may be receiving a higher interest rate as a result of these credits.

Below this is the Calculating Cash to Close section.

Calculating Cash to Close:

This section details the full estimated cash to close on the loan, including the total closing costs, whether you are financing any of your closing costs as part of your loan, how much of a down payment you would be providing as part of your loan, any other funds provided by you, credits from the seller, or other credits.

Adding all these figures together equals the Estimated Cash to Close, which is the estimated amount of money you would be required to bring to closing. Again, we should note that depending on how your loan is structured, you may not be required to bring money to your loan closing itself.

Next is Page 3, which has additional information about your loan.

Lender Information:

At the top of page 3, there will be information about the lender, the loan officer you are working with, and contact information for both.

Next up is the Comparisons section, which you can use to compare this loan to others.

Comparisons:

The section has three pieces of information that you can utilize when comparing this loan offer to ones from other lenders. First, there is the amount you will have paid over five years. Next is the Annual Percentage Rate(APR), which will be different from your interest rate. Finally, there is the Total Interest Percentage, the amount of interest you pay over the length of your loan displayed as a percentage of the total loan amount.

You can use each of these three figures to compare your loan to others.

Next is the Other Considerations section.

Other Considerations:

This section features more information that can be very helpful when determining whether you want to agree to this mortgage or not. First, there is information about your right to receive a copy of your Appraisal. The next section discloses whether the mortgage you have applied for is assumable if you transfer ownership or sell your house. After that is a section about homeowners' insurance and whether you will be required to have a policy as a condition of your loan.

The next section is an important one: late payment. This section details whether the loan has a late payment fee and how that fee is calculated.

After that is a section that advises whether the mortgage loan you have applied for permits refinancing.

The final segment of this section is an important one as well. The last line details how your loan will be serviced. Mortgage servicing is the collection of the mortgage payments themselves. What many people don't know is that the company you end up making your payments to may not be the company you got your loan from.

In many cases, your lender will transfer the servicing rights (the right to collect your mortgage payments) to another company, which will then be the company you send your payments to. One thing to note here: you do not have control or say in which company takes over the servicing of your loan if the lender chooses to transfer servicing.

The last section of Page 3 details whether the lender intends to service the loan itself or transfer it to another company. Pay close attention to this section, especially if you like the customer service provided by the lender.

One thing that sets New American Funding apart is that we service the vast majority of the loans we originate since we believe in creating customers for life.

The last section on the page is the Confirm Receipt section, which you sign to provide proof that you received the Loan Estimate.

Is signing a Loan Estimate binding?

No. One thing to note about signing the Loan Estimate is that signing it does not mean you are accepting the terms of the loan or agreeing to it. Signing it simply means that you acknowledge receipt.

How many days is a Loan Estimate good for?

The fees quoted on the initial Loan Estimate are good for 10 days from the time it is delivered or placed in the mail. During that time, you can either choose to agree to proceed with the loan or not. If you do not agree to proceed, then the lender is not bound to the estimate of charges disclosed. You can discuss alternative loan options with your lender, which may provide you with a revised Loan Estimate with details on your alternative loan and a new estimate of charges.

When should I ask for a Loan Estimate?

Within three days of when you submit your application for a mortgage along with some important information. According to the CFPB, the Loan Estimate must be provided as soon as you have provided the following pieces of information to your lender: name, income, Social Security number, the address and estimated value of the house you're considering buying, and loan amount you are requesting. Once the lender receives your completed application and that information, they will issue the Loan Estimate form to you. Make sure you receive your actual Loan Estimate form from your lender so you can review the terms and costs disclosed and compare them to what other lenders are offering you.

How accurate is a Loan Estimate?

It's important to know that there are a few items on the Loan Estimate that may change throughout the loan process, like the interest rate if you have not locked it in. However, there should be limited variances in fees absent a valid change of circumstance.

Is a Loan Estimate final?

For the most part. As we said, some of the information may change during the origination process but much of what is on the Loan Estimate form should stay the same throughout the process unless there is a valid change of circumstance.

Is a Loan Estimate a pre-approval?

No. It's important to know that receiving a Loan Estimate does not mean that you are pre-approved or approved for this loan. The form is designed to educate you, but it is not a guarantee that you will be approved. That depends on your financial situation and a few other factors.

What happens after signing a Loan Estimate?

After you sign the Loan Estimate, you have some time to review it, make sure you understand it, ask any questions you may have about it, and shop around for alternative mortgage options.

If you agree to the loan, it's important to keep a copy of the Loan Estimate close by, especially when it gets closer to the closing date for your loan. As we stated earlier, you will also receive a Closing Disclosure form at least three business days before your scheduled closing.

You should compare the Closing Disclosure to your Loan Estimate to ensure that all the terms of the loan match what you were provided at the beginning of the process. The Loan Estimate and Closing Disclosure forms look similar and have similar sections. This is by design and enables you to easily compare the forms to each other.

Now, it is possible that some of the costs listed on the Closing Disclosure may not match up exactly with the costs on the Loan Estimate. That's because the costs on the Closing Disclosure are the actual costs, while the Loan Estimate lists the estimated costs and there is a limited variance permitted on certain categories of fees.

You should take the three-day window to review the Closing Disclosure and ask your lender any questions you may have about it. You should also check the form to make sure there are no errors or surprises.

With these two forms in hand, you should be able to make an educated and informed decision about your mortgage. If you have more questions about the Loan Estimate and Closing Disclosure forms, the CFPB has several resources that provide more information.

If all this mortgage talk has you wondering about a mortgage for yourself, check out our mortgage calculator to see what kind of loan you may be able to receive. And if you have questions about the mortgage process, New American Funding's Loan Officers are ready to help.

Smart Moves Start Here.

Smart Moves Start Here.