Inclusive Lending

From Policy to Practice: Shaping an Inclusive Housing Future

May 15, 2024

Homeownership remains a cornerstone of the American dream, symbolizing stability, and opportunity. However, disparities in access to homeownership continue to persist, often mirroring broader socio-economic inequalities. The Biden Administration, as well as other recent policy initiatives, is working hard to address these inequalities. Their focus is on making homeownership more accessible and inclusive, particularly for historically underrepresented communities.

Background on Homeownership Disparities

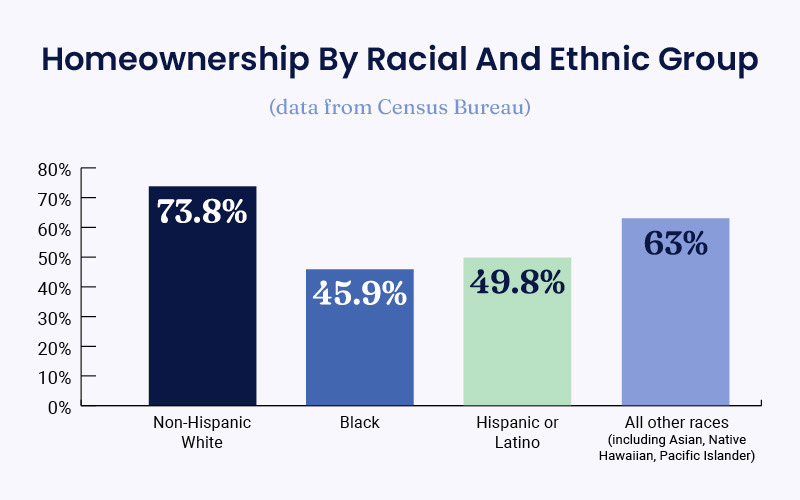

Despite progress over the years, significant disparities in homeownership rates across different demographic groups are still prevalent. As of the end of 2023, the overall U.S. homeownership rate stood at 66%, but this average masks notable differences among racial and ethnic groups. The homeownership rate for Non-Hispanic Whites is 73.8%, while Hispanics stand at 49.8%, Black Americans at 45.9%, and all other races, including Asian and Pacific Islander communities, at 63%.

These numbers reflect deep-seated economic inequalities and the lasting impact of discriminatory practices like redlining, deed restrictions, and biased loan application processes. Recognizing the resilience and potential within communities that have historically been marginalized, our focus must shift towards fostering empowerment and genuine opportunities for all.

Biden's Key Initiatives for Diverse Communities

The Biden Administration has introduced several significant opportunities to increase homeownership in diverse communities:

- American Rescue Plan's Homeowner Assistance Fund (HAF): This fund provides $9.961 billion to aid homeowners struggling due to COVID-19-related financial hardships, with funds distributed across states, U.S. Territories, and Indian Tribes for mortgage payments, insurance, utilities, and other specified needs. It's worth noting that foreclosure filings in 2022 were lower than in any pre-pandemic year for which data is available. Most HAF assistance went to very low-income homeowners, homeowners of color, and female homeowners, highlighting its impact on the most vulnerable groups.

- $13.5 Million in SHOP Grants for Homeownership: The Department of Housing and Urban Development (HUD) awarded $13.5 million in grants through its Self-Help Homeownership Opportunity Program (SHOP) to four nonprofit housing providers. This initiative will facilitate the construction or rehabilitation of 445 homes for low-income, first-time homebuyers. The grants support "sweat equity" contributions from homebuyers and volunteers, significantly reducing the cost of homeownership. This model builds affordable homes and fosters community engagement and participation. It's a chance for buyers to contribute personal effort to the construction of their future homes. This approach has been a critical element in HUD's strategy to increase accessible and affordable housing options for Americans, particularly those from underrepresented groups.

- FY24 Choice Neighborhoods Planning Grant: Announced by HUD Acting Secretary Adrianne Todman, this $10 million initiative supports local planning efforts to revitalize communities, emphasizing housing creation, preservation, and enhancement of amenities such as grocery stores and parks. By involving communities in developing these comprehensive Transformation Plans, the grant aims to improve the quality of life and attract private investment. With about 20 communities set to benefit, from small towns to large urban areas and tribal communities, the potential for positive impact is significant. These communities will also receive priority in future Implementation Grant applications, which provide up to $50 million to implement community transformation strategies.

Legislative and Regulatory Reforms

Key legislation and reforms play a pivotal role in supporting these initiatives:

- Fair Housing Act: This pivotal piece of legislation continues to play a critical role in combating housing discrimination. Enacted in 1968, it prohibits discrimination concerning the sale, rental, and financing of housing based on race, color, national origin, religion, sex, familial status, and disability.

- Dodd-Frank Act: The Dodd-Frank Act was a critical legislative response to the financial crisis of 2008, introducing measures to counteract the predatory lending practices that had played a role in the housing market's collapse. Specifically, Title XIV of the Act, known as the Mortgage Reform and Anti-Predatory Lending Act, set robust standards for responsible lending, mandating that creditors confirm a borrower's ability to repay a loan.

- Community Reinvestment Act (CRA) and Home Mortgage Disclosure Act (HMDA): Both actions are critical to fostering fair lending and a clear, transparent housing finance system. The CRA, established in 1977, is designed to encourage financial institutions to meet the credit needs of all members of their communities, particularly those in low- and moderate-income areas. The HMDA, which took effect in 1975, mandates that financial institutions must make public their data on housing-related lending. This transparency is crucial in highlighting potential discriminatory lending practices and enforcing anti-discrimination laws.

Significant Update to the CRA: The proposal, scheduled for January 2026, is a significant update to the CRA and would require banks to strengthen their lending to low- and moderate-income communities and help end discrimination in lending.

Building Bridges: Best Practices for Fostering Inclusivity in Homeownership

Best practices for mortgage professionals and policymakers are essential to turning these policies into effective outcomes. For example, promoting workforce diversity and cultural awareness in the mortgage industry helps to better connect with and serve underrepresented communities.

Mosi Gatling, SVP of Strategic Growth & Expansion at New American Funding, shares a powerful message on diverse hiring. "The employees that you have are essential to the success of what a company does." NAF has approximately 4,100 employees, with 53% of them being female, 37% being from diverse communities, and 19% specifically being Hispanic. Part of the solution to closing the gap in diverse homeownership is building a diverse and inclusive workplace that mirrors the communities they aim to serve, underscoring the importance of cultural competence and authenticity in fostering homeownership opportunities.

Future Outlook and Recommendations

Moving from policy to practical solutions is an intricate journey, but an essential one. By continuously honing these strategies and diligently putting them into practice, the vision of homeownership equity can be realized. In doing so, we significantly enhance the economic and social landscape of the nation.

For more in-depth insights into the challenges and strategies surrounding diverse homeownership, be sure to check out our latest white paper, "Empowering Homeownership: Bridging the Gap for Diverse Communities," which delves into data insights and misconceptions about homeownership in diverse communities.