Housing News

Homeowners, This Is How Much a Refinance Can Save You Every Time Rates Fall

September 18, 2025

Homeowners hoping to save money (and who isn’t right now?) may be watching mortgage rates drop with glee.

Even small declines in mortgage interest rates may lead to lower monthly housing payments if homeowners refinance their mortgages. Over the course of a 30-year loan, lower rates could help homeowners save tens of thousands of dollars—or even more.

“Homeowners should start working with a lender,” said Anthony Ramirez, a San Diego-based loan consultant at New American Funding. “You have to be in a position to jump on lower rates.”

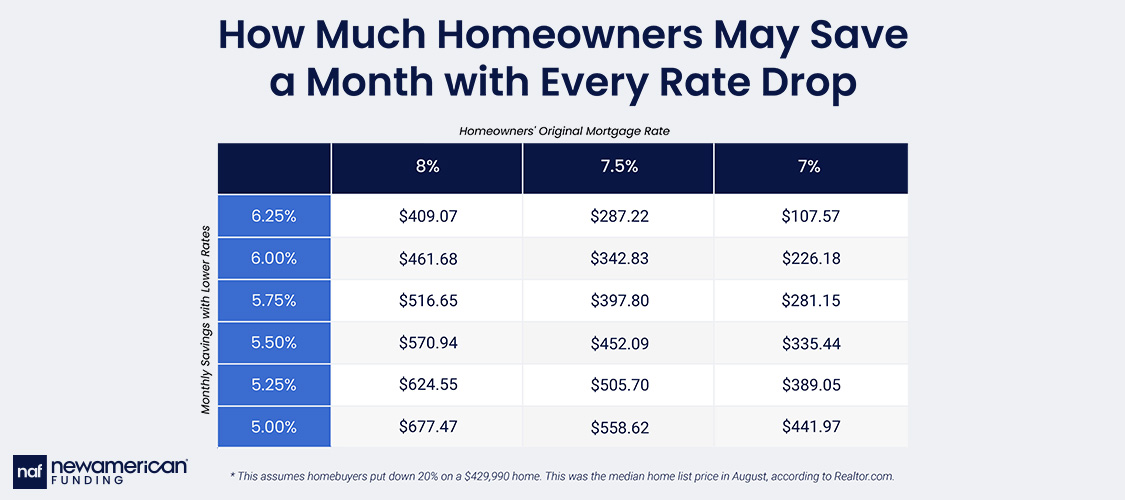

Say you took out a mortgage in October 2023 when mortgage rates hovered around 8% mark, according to Mortgage News Daily. With interest rates now around 6.25%, you might be able to save just over $400 a month.

That translates into saving nearly $4,900 in interest a year—and about $146,000 over the life of a 30-year, fixed-rate mortgage.

This assumes homeowners put down 20% on a median priced home of $429,990, leaving them with a $343,992 mortgage. The home list price is from August 2025, according to Realtor.com data.

Someone who bought in January of this year, when mortgage rates were about 7.25%, could save nearly $230 a month, almost $2,750 a year, and more than $82,000 over a 30-year loan.

That’s with rates dropping just a single percentage point.

“Think about your short-term and long-term plans for the property,” said Ramirez. “If you plan on keeping that property, definitely consider doing a refinance. Try to get that lower interest rate payment.”

With the U.S. Federal Reserve poised to drop rates further this year, mortgage rates could continue to decline. (The Federal Funds rate is separate from mortgage rates, but mortgage rates generally move in a similar direction.)

Every time mortgage rates fall by three-quarters of a percentage point less than your current rate, Ramirez recommends homeowners look at if it makes financial sense to refinance. A refinance usually costs homeowners 2% to 6% of the loan amount.

“Sit down with a mortgage professional who can go over the net financial benefit to you,” said Ramirez. “You have to figure out what’s best for you in your situation.”

Anthony Ramirez NMLS # 249819

Smart Moves Start Here.

Smart Moves Start Here.