Housing News

Homebuyers, Your Purchasing Power Went Up: How Much More Home You Can Afford with Every Rate Drop

September 17, 2025

Homebuyers who missed out on record-low mortgage interest rates during the pandemic have had a tough few years in the housing market. Home prices surged, rates rose, and the number of homes for sale dried up.

Now, buyers may finally be getting some relief—and increased purchasing power as mortgage rates fall. This may put more expensive homes within reach.

“The lower the mortgage rate, you’re either going to get a lower payment on the same home you’re purchasing, or you can buy more home for the same payment,” said Ray Williams, executive vice president, Consumer Direct Division at New American Funding.

Mortgage rates have been steadily coming down in anticipation of the U.S. Federal Reserve’s September meeting. While the Fed’s benchmark rate is separate from mortgage rates, mortgage rates often fall when the Fed is expected to lower rates.

And that’s been happening over the last few weeks.

Mortgage rates averaged 6.13% as of Sept. 16 for 30-year, fixed-rate loans, according to Mortgage News Daily. That’s down from a high this year of 7.26% on Jan. 13.

“It’s very difficult to afford a home right now, especially for first-time buyers,” said Williams. “Lower rates increase your buying power.”

And as rates come down further, “you can always refinance,” he said.

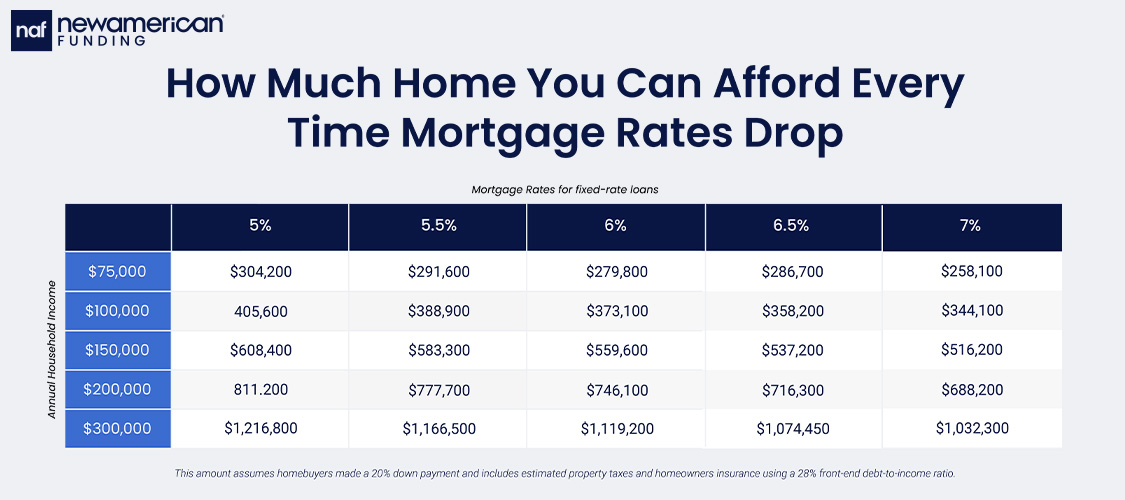

Even small declines in rates can help buyers afford pricier properties.

Take a family earning $100,000. They could afford a roughly $337,400 home with rates at 7.25%. (This assumes they put down 20% and includes property taxes and homeowner’s insurance.)

With rates now around 6.25%, the same family could afford a home priced at $365,500. That’s about $28,000 more in purchasing power. If rates tumbled to 5.25%, their budget might increase by nearly $60,000 to $397,100.

As rates come down, homebuyers want to be ready to make a move. They should get their financial paperwork ready and meet with a lender to see how much home they may be able to afford.

“You shouldn’t wait to buy a home,” said Williams. “You need to start your homeownership as soon as you can. You want to be building that home equity.”

Ray Williams NMLS # 270010

Smart Moves Start Here.

Smart Moves Start Here.