Housing News

How Today's Interest Rates May Affect You

November 21, 2019

Today we are going to talk about what's happening with interest rates.

The end of October saw another FOMC meeting where the Fed dropped their benchmark rate 25bps to the range of 1.50 to 1.75%. This was the third meeting in a row that they dropped interest rates with only one FOMC meeting left in 2019. It doesn’t appear we will see any movement at the next meeting as the probability that the Fed will drop rates again in December is less than 5%. One interesting note is that the market is only pricing in a 75% chance that the Fed will drop rates in 2020. So it appears, at least for right now, that the Fed is done lowering rates in this “mid-cycle adjustment”.

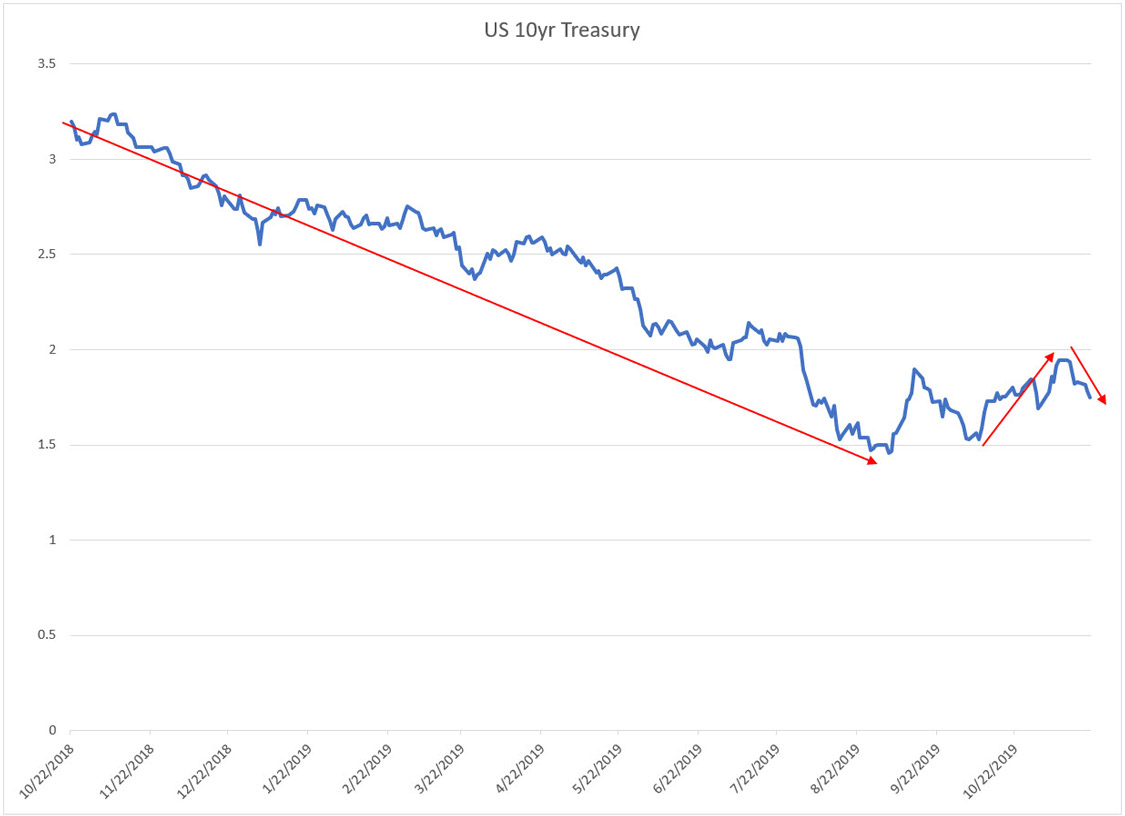

Moving over to Treasuries, we saw the 10-year shoot higher almost 2 weeks ago to 1.94%. The market started pricing in a higher probability that the trade war with China comes to an end and that has pushed stock prices up to new record highs. Since that time, however, we are seeing rates start to creep back down with the 10-year currently at 1.75%.

In terms of the economy, the unemployment rate is still near record lows, the labor force participation rate is up, GDP is stable at 2.0% and inflation is still hovering between 1.5 and 2.0%. The one area of concern is manufacturing, with certain indices showing a level of weakness not seen in 2-3 years.

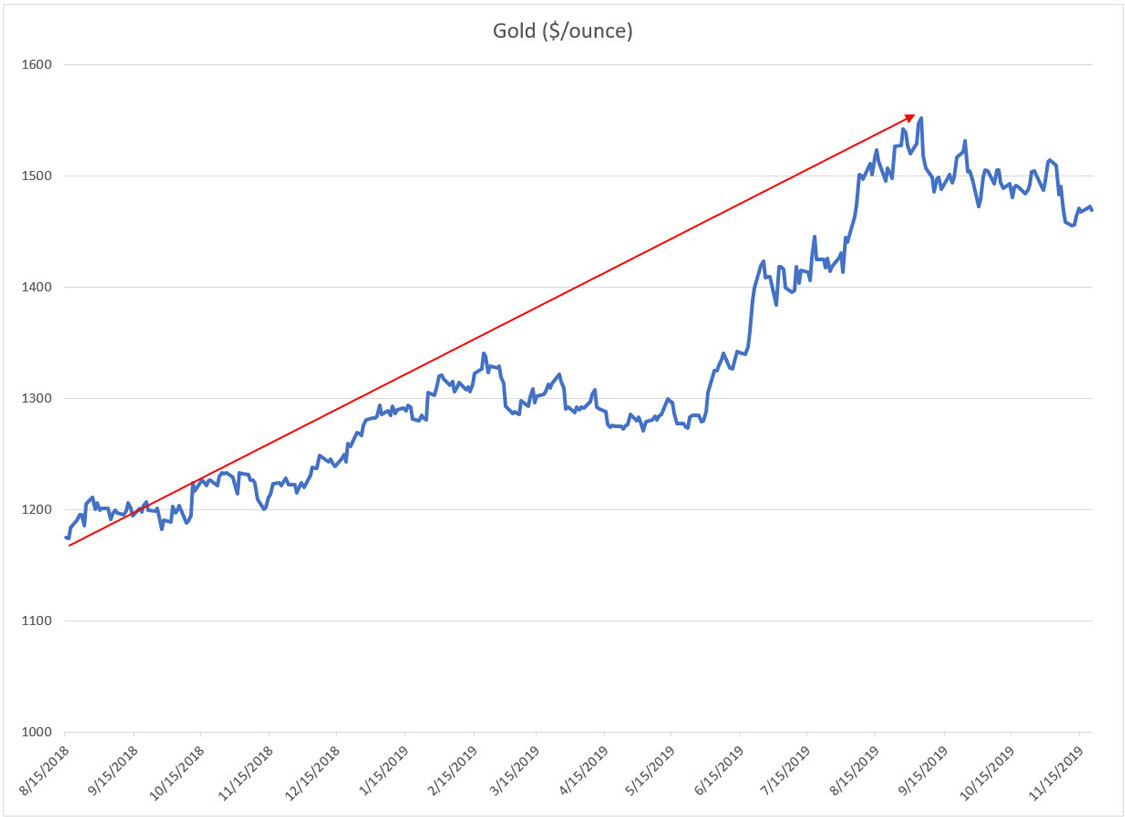

If you haven’t noticed, the price of gold has shot up over the past year with it now trading over $1,470 an ounce vs around $1,175 during the middle of last year. The risks to growth and general economic uncertainty around the globe have pushed investors into the commodity.

In the coming weeks, you should keep an eye on the following items:

- GDP comes out next Wednesday for the 3rd quarter, along with personal spending and income. More likely than not the market will remain relatively quiet with the Thanksgiving holiday.

- Also, pay attention to the trade war. The current levels of interest rates and stock prices are based upon the hope of an end to the trade war, or at least progress. If talks stall or the negotiations move backwards then it's very possible rates push back down again.

- Lastly, there has been a lot of talk of impeachment and at the same time stock prices keep moving higher. Impeachment could stagnate growth and perhaps the market is mis-pricing risk.