Housing News

When Will Mortgage Rates Go Down in 2024?

March 9, 2023

Owning a home is a dream for many, and the path toward achieving it is often connected to the pattern of mortgage rates. In 2024, as prospective buyers and current homeowners watch the market, the constant question is: When will mortgage rates go down? In addition to examining the factors that determine mortgage rates, this extensive guide also provides:

- Insight into their current status.

- Predictions from experts for the upcoming year.

- The overall effect on borrowers.

Factors Influencing Mortgage Rates

Mortgage rates are vital to the housing market. Many economic factors affect them. Key among these are:

Economic Data: Economic growth indicators like GDP, employment levels, and consumer spending are used to decide whether to change interest rates. A strong economy usually means interest rates will go up. When the economy is doing poorly, interest rates tend to go down.

Inflation: Inflation is a silent but key factor that directly affects how interest rates are set. To combat high inflation, central banks may increase interest rates. Higher interest rates make borrowing more expensive, which can reduce spending and borrowing by consumers and businesses. This, in turn, can help to slow down the economy and bring inflation rates down.

Financial Market: Mortgage rates can change based on the overall market, including how stocks and investors feel. When the economy is shaky, people often turn to safer investments like bonds, which can push mortgage rates down.

Federal Reserve: The Federal Reserve makes decisions about monetary policy that affect how much people pay for a mortgage. These decisions don't directly change mortgage rates but have an impact. By setting the Federal Funds rate, the interest rate at which banks lend to each other overnight, the Federal Reserve influences the overall interest rate environment, including the rates consumers pay on mortgages. This indirect effect can either make borrowing more expensive or more affordable, depending on the direction of policy adjustments.

Treasury Yield: The 10-year Treasury bond yield is a benchmark, with mortgage rates often mirroring its movements. People who buy and sell stocks think of bonds as a safer investment. How much money bonds make tells us how people who invest feel about the economy. When investors want more money from these bonds, mortgage rates usually increase. When interest rates on these bonds decrease, mortgage interest rates also decrease. This means that it becomes less expensive for people who want to buy a house to borrow money.

Interest Rate Environment: Global interest rates and international central bank policies can influence the United States' mortgage rates. These rates' adjustment abroad can affect investor demand for U.S. Treasury bonds, impacting U.S. mortgage rates.

Current State of Mortgage Rates

This week has brought some slight shifts in mortgage rates, offering a noteworthy opportunity for individuals interested in securing a new mortgage or refinancing an existing one. It's important to understand that the interest rate available to you for both 30-year and 15-year fixed mortgages can vary widely, heavily influenced by personal factors such as your credit history, the loan amount, and the property's location. Given the dynamic nature of mortgage rates and their personalized application, we recommend closely monitoring market trends and seeking advice from mortgage professionals.

Timing Factors

The reasons for the expected decrease in interest rates are:

- Inflation is starting to get better.

- The Federal Reserve might lower interest rates.

Future economic factors and decisions the Federal Reserve makes will determine the timing. Market conditions, including housing supply and demand, existing and new home sales, and other economic indicators, will further drive the mortgage rate landscape.

Current Market Conditions

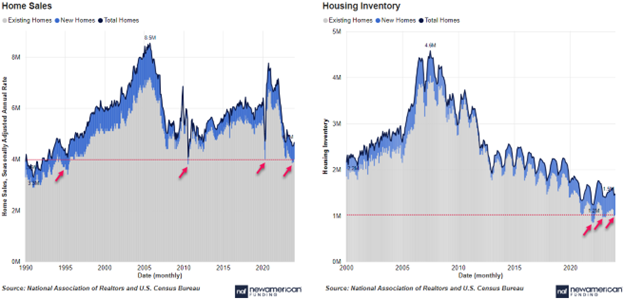

As we delve into the first set of housing market data for 2024, we're witnessing a cautiously optimistic market, with both new and existing home sales showing signs of improvement from the previous month, yet still facing challenges. In January, new home sales saw a slight year-over-year increase, while existing home sales continued to hover near 30-year lows. The market is further complicated by a significant shortage in inventory with housing inventory -63% below its 2008 peak and -25% below the January average from 2015 to 2019 making it more competitive to get an offer accepted.

There still needs to be more homes for buyers, which keeps pushing up prices. In January, the typical cost for an existing home hit a record high of $379,000. This makes it even harder for people to afford a home. The market for new homes is getting better for buyers than the market for existing homes, which still favors sellers. Despite the challenges, people are cautiously optimistic that the market will change. This can be seen in how buyers and sellers interact and how people still try to buy homes even as prices increase.

Impact on Borrowers

For those interested in the market, reduced rates present an opportunity to make it easier to become a homeowner or refinance. A strong credit score is important, as it is crucial to getting favorable interest rates.

Understanding mortgage rates is crucial for consumers looking to achieve their dream of homeownership or secure a more favorable rate. By staying informed about market trends and seeking expert guidance, borrowers can make informed decisions about their mortgage and refinancing options. This knowledge empowers individuals and families to navigate the ever-changing landscape of mortgage rates, unlocking the doors to a brighter future and creating a place they proudly call home.

FAQ

- What is a mortgage rate? A mortgage rate is the interest rate a lender charges on a mortgage loan. It determines the cost of borrowing and affects the monthly mortgage payment.

- When should I lock my mortgage rate? The timing of locking in a mortgage rate depends on individual circumstances and market conditions. It's advisable to consult with a mortgage professional who can provide guidance based on your specific situation and the current market environment. It's worth noting that New American Funding (NAF) offers a unique 5-year protection pledge, which allows borrowers to refinance their mortgage within the first five years without paying lender fees should interest rates fall during that time. This pledge provides flexibility for borrowers wanting to take advantage of lower rates.

- When will home prices and housing supply improve? Home prices and housing supply improvement depend on various factors, including market conditions, construction activity, and economic factors. Although mortgage rates can impact these factors, they are not the only factors that determine them.