Homebuyers

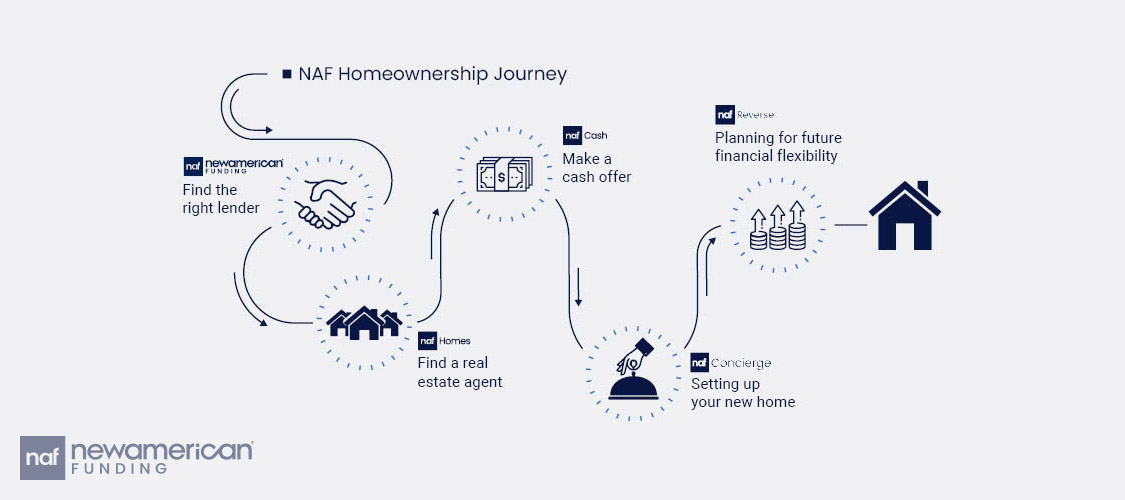

How the Right Lender Can Guide You Through the Entire Homeownership Journey

June 11, 2024

Imagine you are ready to buy your home. You've been saving, planning, and dreaming of this moment, and now it's finally within reach. But where do you start? Navigating the homebuying process can be daunting, but understanding the essential steps can make your journey smoother and more efficient. From obtaining the initial loan approval to finally moving into your new home, this article outlines the crucial stages to ensure a seamless experience. Read on to learn how to navigate these steps and have a great experience on this journey.

Step 1: Securing the Loan

Your journey begins with the crucial step of securing a home loan. At New American Funding, the process is straightforward and supportive. You meet with a Loan Officer who explains all your options and helps you find the best mortgage solution tailored to your needs. This personalized approach demystifies homebuying's financial aspect and sets the tone for your homebuying journey. Here are a few tips to navigate this part of the process:

- Get Preapproved Early: Start by securing a loan preapproval to understand your budget and strengthen your offer position.

- Explore Your Options: Discuss various loan types and terms with your Loan Officer to find the best mortgage solution tailored to your financial needs.

- Ask Questions: Always feel free to ask your Loan Officer for clarification on any financial aspects.

- Stay Organized: To facilitate a smooth approval process, maintain good records of all financial documents and communications with your Loan Officer.

Step 2: Finding Your Home

With preapproval in hand, you're introduced to NAF Homes, an affiliated company of New American Funding. At this step, you're matched with a real estate agent who specializes in your local market. These agents, equipped with extensive local knowledge and advanced technology, guide you through the home searching process. They understand the importance of communication, making sure you're informed and comfortable at every step.

As Susie Wright, SVP of NAF Homes, states, “Buying a home is one of life’s most important and exciting purchases. As a potential homebuyer you can count on NAF and NAF Homes to successfully guide you through your homebuying journey. Our team works together to support you, answer questions, and provide you with need to know when purchasing a home. NAF Homes and our partner agents work side by side with your NAF Loan Officer to make sure you not only have a seamless experience, but a team that takes care of everything, so you can focus on making your house a home.”

Here are some tips to help you on your home search:

- Define Your Priorities: Before starting your search, list your must-haves and deal-breakers to help guide the home selection process.

- Explore Different Neighborhoods: Take time to visit various areas to get a feel for the community and local amenities.

- Stay Flexible: Be open to adjusting your criteria as you learn more about what's available in your market.

- Act Quickly: In a competitive market, be prepared to make decisions swiftly to secure a home that meets your needs.

Step 3: Making a Competitive Offer

You've found the right home, but it's in a competitive market. This is where NAF Cash, an affiliated company of New American Funding, comes into play. By making an all-cash offer through NAF Cash, your bid stands out, significantly increasing your chances of acceptance.

Miguel Villegas, Director of NAF Cash, states, “NAF Cash is a unique and innovative program that helps clients buy their dream home with cash and get all the benefits from it. NAF Cash understands the challenges faced by homebuyers and with NAF brings this solution in competitive markets.” This unique program helps you navigate competitive markets. It simplifies the transition by allowing you to move in immediately while selling your previous home at your own pace.

A cash offer can make a significant difference. It provides:

- Certainty: Cash can remove buying contingencies, enhancing the likelihood of the transaction closing.

- Competitive Edge: Sellers prefer cash offers, especially in competitive markets, increasing your chances of acceptance.

- Faster Closing: Cash transactions can close faster, a benefit sellers appreciate.

- Less Stress: You can move into your new home immediately, even before selling your old one, reducing timeline stress.

- Cost Savings: Cash buyers often receive discounts from sellers, potentially lowering the purchase price.

Step 4: Setting Up Your New Home

As you approach the exciting milestone of moving into your new home, NAF Concierge is here to streamline the process. This complimentary service efficiently coordinates the setup of essential utilities and home services, making sure everything is ready when you move into your new home.

NAF Concierge removes the hassle of managing tasks, from scheduling electricity, gas, and water installations to arranging internet and home security systems. This allows you to focus more on settling into your new space rather than getting bogged down by the details. NAF Insurance is another complimentary service. NAF Insurance swiftly secures the best coverage to protect your new home and provides peace of mind from day one.

Phil Miller, NAF Vice President of Strategic Partnerships, highlights the value of this service, "NAF is here to help homebuyers with so much more than just a mortgage. Through our industry-leading NAF Insurance & NAF Concierge offerings, we can streamline the homeownership experience by connecting customers with the key products, services, and coverages that help turn a house into a home, saving customers hours of precious time and hundreds of hard-earned dollars."

Step 5: Planning for the Future

Your journey doesn't end here. As you age, you may want to tap into the equity in your home to fund various personal expenses, like trips or home renovations. NAF Reverse is designed to help with that. This program allows older homeowners to tap into their home equity without the immediate burden of monthly payments. By converting part of your home equity into cash, you can enhance your financial flexibility during retirement.

Shannon Robinson, Senior Vice President of the Reverse Division at NAF, highlights the value of this service, "We like to think of our NAF customers as customers for life. Our NAF Reverse division helps clients tap into their home equity to secure funds for retirement, home improvements, home care, and other needs to maintain their financial well-being." This approach helps manage finances more effectively and provides peace of mind and security as you enjoy your retirement years.

A Seamless Journey from Start to Finish

Embarking on the homebuying journey can be overwhelming. When you follow these steps and team up with NAF, you're supported every step of the way. NAF's comprehensive services provide a smooth and stress-free experience. We are here to help you with your entire home journey. We aim to simplify the process and enhance your journey as you settle into your new home and beyond. Contact us to launch your homeownership journey today.